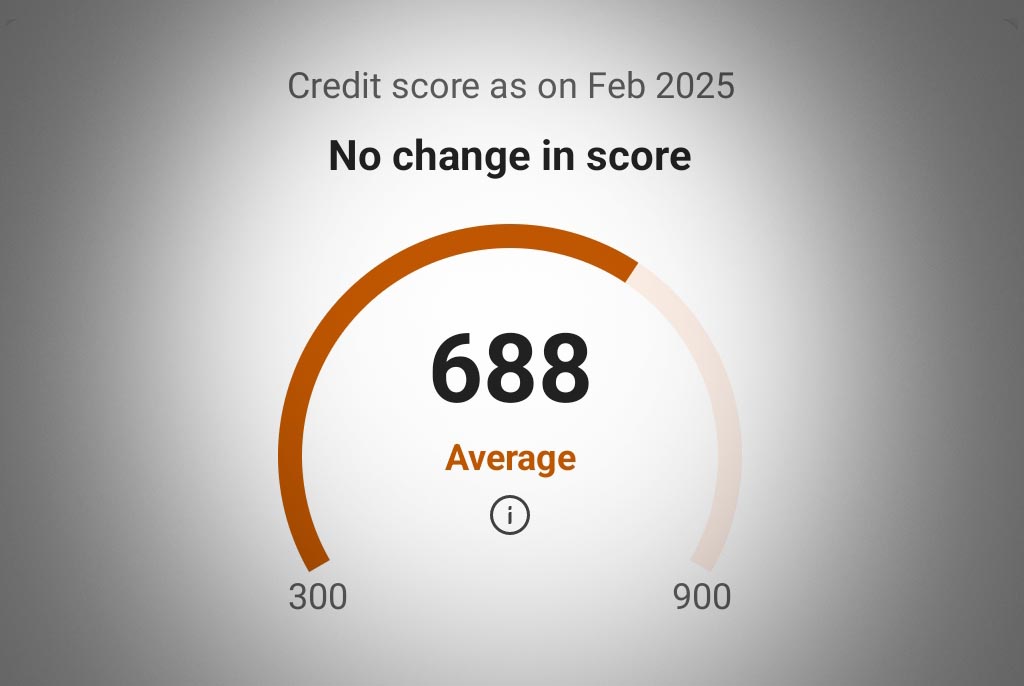

In today’s financial landscape, your credit score is one of the most critical factors that determine your eligibility for loans, credit cards, and other financial products. A good credit score not only increases your chances of approval but also helps you secure better interest rates and terms. Among the various credit bureaus in India, the Credit Information Bureau (India) Limited (CIBIL) is the most widely recognized. Your CIBIL score, which ranges from 300 to 900, is a numerical representation of your creditworthiness. The higher your score, the better your chances of securing credit.

The good news is that you can check your CIBIL score for free online using your PAN number. In this comprehensive guide, we’ll walk you through the step-by-step process of checking your CIBIL score, explain why it’s important, and provide tips on how to improve it.

Why is Your CIBIL Score Important?

Before diving into the process of checking your CIBIL score, it’s essential to understand why it matters. Here are some key reasons:

- Loan Approvals: Banks and financial institutions use your CIBIL score to assess your creditworthiness. A high score increases your chances of loan approval.

- Interest Rates: A good credit score can help you secure loans at lower interest rates, saving you money in the long run.

- Credit Card Approvals: Credit card issuers also rely on your CIBIL score to determine your eligibility for premium credit cards.

- Financial Health: Your CIBIL score reflects your financial discipline and repayment behavior. Regularly monitoring it helps you stay on top of your financial health.

- Employment Opportunities: Some employers, especially in the financial sector, may check your credit score as part of their hiring process.

Step-by-Step Guide to Check Your CIBIL Score for Free Using Your PAN Number

Checking your CIBIL score is a straightforward process. Follow these steps to access your credit score online:

Step 1: Visit the Official Website

Start by visiting the official website of TransUnion CIBIL or any other authorized credit bureau such as Experian, Equifax, or CRIF High Mark. These bureaus are regulated by the Reserve Bank of India (RBI) and provide reliable credit information.

- TransUnion CIBIL: www.cibil.com

- Experian India: www.experian.in

- Equifax India: www.equifax.in

- CRIF High Mark: www.crifhighmark.com

Step 2: Click on “Get Your CIBIL Score”

Once you’re on the homepage, look for an option like “Get Free CIBIL Score” or “Check CIBIL Score.” This option is usually prominently displayed to attract users. Click on it to proceed.

Step 3: Enter Personal Details

You’ll be redirected to a page where you’ll need to provide the following details:

- PAN Number: Your Permanent Account Number (PAN) is mandatory for checking your CIBIL score. It helps the credit bureau verify your identity and pull up your credit history.

- Name: Enter your full name as per your PAN card.

- Date of Birth: Provide your date of birth in the required format.

- Email ID: Enter a valid email address where you can receive updates and notifications.

- Mobile Number: Provide an active mobile number for OTP verification.

- Address: Some platforms may ask for your residential address.

Ensure that all the details you provide are accurate to avoid any discrepancies.

Step 4: Verify Your Identity

After entering your details, you’ll receive a One-Time Password (OTP) on your registered mobile number or email. Enter the OTP to verify your identity. This step is crucial for ensuring that only you can access your credit information.

Step 5: Access Your CIBIL Score

Once your identity is verified, you’ll be able to view your CIBIL score on the screen. Some platforms may require you to create an account before showing your score. If prompted, follow the instructions to set up your account.

Step 6: Download or View Your Credit Report

Most credit bureaus offer one free credit report per year. After checking your score, you can download or view your credit report for free. The report provides detailed insights into your credit history, including:

- Credit Accounts: Details of your loans, credit cards, and other credit facilities.

- Payment History: Your track record of repaying debts on time.

- Credit Utilization: The percentage of available credit you’re using.

- Credit Inquiries: A list of entities that have accessed your credit report.

If you need a more detailed report or want to check your score multiple times, you may need to pay a nominal fee.

Alternative Websites to Check Your Credit Score for Free

In addition to the official credit bureau websites, several other platforms allow you to check your credit score for free. These platforms partner with credit bureaus to provide users with easy access to their credit information. Some popular options include:

- Bajaj Finserv: www.bajajfinserv.in

- Paisabazaar: www.paisabazaar.com

- BankBazaar: www.bankbazaar.com

- Paytm: www.paytm.com

- Experian India: www.experian.in

These platforms are user-friendly and often provide additional tools and resources to help you understand and improve your credit score.

Tips to Improve Your CIBIL Score

If your CIBIL score is lower than expected, don’t worry. There are several steps you can take to improve it over time:

- Pay Your Bills on Time: Late payments can significantly impact your credit score. Set up reminders or automatic payments to ensure you never miss a due date.

- Reduce Credit Utilization: Try to keep your credit utilization below 30% of your available credit limit.

- Avoid Multiple Credit Applications: Applying for multiple loans or credit cards within a short period can lower your score.

- Maintain a Healthy Credit Mix: A balanced mix of secured (e.g., home loan) and unsecured (e.g., credit card) credit can positively impact your score.

- Check Your Credit Report Regularly: Look for errors or discrepancies in your credit report and report them to the credit bureau for correction.

- Close Unused Credit Accounts: Keeping too many unused credit accounts open can negatively affect your score.

Frequently Asked Questions (FAQs)

1. Is it safe to check my CIBIL score online?

Yes, it’s safe to check your CIBIL score online as long as you use authorized platforms. Ensure that the website is secure (look for “https” in the URL) and avoid sharing your details on suspicious websites.

2. How often should I check my CIBIL score?

It’s a good practice to check your CIBIL score at least once a year. However, if you’re planning to apply for a loan or credit card, check it a few months in advance to address any issues.

3. Can I check my CIBIL score without a PAN card?

No, a PAN card is mandatory for checking your CIBIL score as it serves as a unique identifier.

4. Does checking my CIBIL score affect my credit rating?

No, checking your own CIBIL score is considered a “soft inquiry” and does not affect your credit rating.

5. What is a good CIBIL score?

A CIBIL score above 750 is considered good and increases your chances of loan approval.

Conclusion

Your CIBIL score is a vital aspect of your financial health, and checking it regularly is a smart financial habit. By following the steps outlined in this guide, you can easily check your CIBIL score for free online using your PAN number. Remember, maintaining a good credit score requires discipline and responsible financial behavior. If your score isn’t where you want it to be, take proactive steps to improve it over time. With a strong credit score, you’ll be well-positioned to achieve your financial goals.

So, what are you waiting for? Visit one of the authorized platforms today and take the first step toward understanding and improving your credit health!